2026 JAMB Subject Combination for Accounting: Complete Requirements Guide

The JAMB subject combination for Accounting determines your eligibility for admission into any Nigerian university. Many candidates lose admission opportunities because they register for wrong subject combinations or fail to meet specific institutional requirements. Understanding these requirements early helps you prepare adequately and avoid costly mistakes.

This guide covers O’Level requirements for Accounting, JAMB subject combinations, Direct Entry qualifications, universities offering the program, and career prospects. You will also find answers to common questions about studying Accounting in Nigerian universities.

NOTE: This subject combination requirement also suitable for the following courses; Accountancy/Finance/Accounting

Read Also: Jamb Subject Combination for all courses

O’Level Results Requirements for Accounting

Your O’Level results form the foundation of your university admission process. Most universities require five credit passes in relevant subjects at not more than two sittings. The quality of these results often determines whether you proceed to the next stage of admission screening.

A. O’Level Requirements for Accounting

You need five credit passes including English Language, Mathematics, and Economics. Most universities also require one or two of these subjects: Commerce, Accounts, or Government. Some institutions accept Geography or any Social Science subject as alternatives.

The credit passes must be obtained at SSCE, NECO, NABTEB, or GCE level. You can combine results from two sittings, but single sitting results often receive preference during admission screening.

B. How to Combine Two Sitting Results Strategically

When combining results from two sittings, ensure both results contain English Language and Mathematics with minimum C6 grades. Use your stronger result as your primary certificate and supplement with the second sitting for remaining subjects.

Avoid repeating subjects across both sittings unless you improved significantly. Universities scrutinize repeated subjects and may favor candidates with better single sitting performance. Always check specific institutional policies before combining results.

C. Common O’Level Mistakes That Kill JAMB Efforts

Many candidates register for JAMB without completing their O’Level requirements. Some sit for wrong subject combinations, forgetting Economics or Mathematics which are compulsory for Accounting. Others assume that Financial Accounting can replace Economics, leading to disqualification.

Another common error involves using three sittings instead of two. Most universities reject candidates who present results from more than two examination sittings, regardless of JAMB scores.

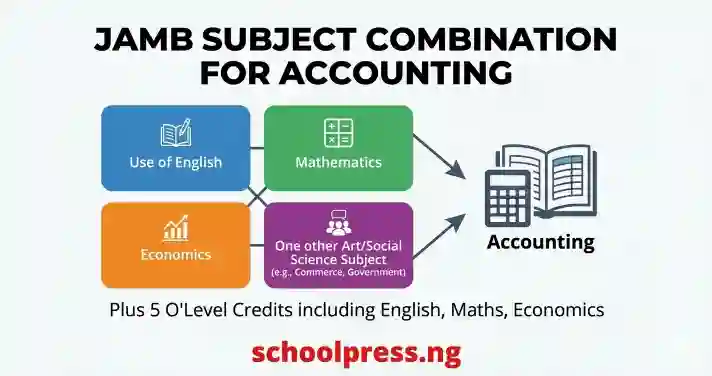

JAMB Subject Combination for Accounting

Your UTME subject selection directly impacts admission eligibility. Registering for incorrect subjects means automatic disqualification, even with excellent scores. Universities strictly enforce these combinations without exceptions for most candidates.

A. UTME/JAMB Subjects Combination for Accounting

The standard JAMB subject combination for Accounting includes Mathematics, Economics, and one other Social Science subject. Mathematics is compulsory and non-negotiable across all Nigerian universities offering Accounting programs.

For your third subject, most universities accept Government, Commerce, or Geography. Some institutions also accept Business Studies where available. Economics remains mandatory as your second subject after Mathematics.

B. Minimum UTME/JAMB Score Requirements

1. Federal Universities: 180 to 220 points depending on the institution. Universities like University of Lagos, Ahmadu Bello University, and University of Nigeria typically require 200 and above for competitive consideration.

2. State Universities: 160 to 200 points across different states. Lagos State University and Ekiti State University usually admit candidates from 180 points, while others accept lower scores based on available spaces.

3. Private Universities: 140 to 180 points for most institutions. Private universities often show more flexibility with cut-off marks but maintain strict requirements for O’Level results and subject combinations.

C. UTME/JAMB Special Consideration (Waiver) for Accounting

Some universities accept subject waivers under specific conditions. University of Benin accepts Geography in place of Economics for candidates with strong Mathematics backgrounds. Obafemi Awolowo University considers Commerce as alternative to Economics in exceptional cases.

Ambrose Alli University and Delta State University occasionally grant waivers for the third subject requirement. However, Mathematics and Economics remain non-negotiable across all institutions offering these exceptions.

Direct Entry Requirements for Accounting

Direct Entry provides an alternative admission route for candidates with advanced level qualifications. This pathway allows you to enter 200 level directly, reducing your program duration from four years to three years.

Direct Entry suits candidates who possess A’Level, NCE, OND, or ND certificates in relevant fields. If you studied Business Education, Accounting Technician programs, or related diplomas, this route offers faster completion of your degree program.

A. Direct Entry Requirements and Qualifications for Accounting

Universities accept two A’Level passes in Economics and any other subject from Government, Geography, or Mathematics. Your A’Level results must include at least one relevant subject to the Accounting program.

For NCE holders, you need merit level passes in Business Education or Social Studies Education. OND or HND holders require Upper Credit in Accountancy, Banking and Finance, or Business Administration from recognized polytechnics.

B. O’Level Direct Entry Requirements for Accounting

Direct Entry candidates must still satisfy the five credit O’Level requirements. You need credits in English Language, Mathematics, Economics, and two other relevant subjects at not more than two sittings.

Some universities waive certain O’Level requirements for candidates with very strong A’Level or diploma results. However, English Language and Mathematics credits remain compulsory for all Direct Entry applicants regardless of other qualifications.

C. Direct Entry Special Consideration (Waiver) for Accounting

University of Ilorin accepts HND holders with Lower Credit for Direct Entry into Accounting. Nnamdi Azikiwe University admits candidates with Pass grades in A’Level if they have strong O’Level results.

Bayero University Kano and University of Maiduguri grant waivers for candidates with professional accounting qualifications like ICAN Foundation level. Federal University of Technology, Minna accepts relevant National Diploma certificates with minimum Lower Credit grades.

Universities Offering Accounting

1. Federal Universities: University of Lagos, University of Nigeria Nsukka, Ahmadu Bello University Zaria, Obafemi Awolowo University, University of Benin, University of Ilorin, Bayero University Kano, University of Calabar, Federal University of Technology Minna, and University of Maiduguri.

2. State Universities: Lagos State University, Ekiti State University, Ambrose Alli University, Delta State University, Adekunle Ajasin University, Osun State University, Kogi State University, Rivers State University, Enugu State University of Science and Technology, and Taraba State University.

3. Private Universities: Covenant University, Babcock University, Bowen University, Redeemers University, Achievers University, Lead City University, Bells University of Technology, Crawford University, Caleb University, and Baze University.

Career Prospects in Accounting

Accounting graduates enjoy diverse career opportunities across public and private sectors. The profession offers competitive salaries, professional growth, and international mobility. Understanding these prospects helps you make informed decisions about specializing in Accounting.

1. Public Accountant: You provide audit, tax, and consulting services to individuals and businesses. Public accountants work in accounting firms ranging from small practices to Big Four companies. The role requires professional certifications like ICAN or ACCA.

2. Management Accountant: You prepare financial reports, budgets, and forecasts for organizational decision-making. Management accountants work within companies across all industries. This role combines financial analysis with strategic business planning.

3. Tax Consultant: You advise clients on tax planning, compliance, and optimization strategies. Tax consultants help businesses minimize tax liabilities while maintaining regulatory compliance. The position requires deep understanding of tax laws and regulations.

4. Forensic Accountant: You investigate financial crimes, fraud, and irregularities for legal proceedings. Forensic accountants work with law enforcement, legal firms, and corporations. This specialized field combines accounting knowledge with investigative skills.

5. Internal Auditor: You examine organizational processes to ensure compliance, efficiency, and risk management. Internal auditors work within corporations, government agencies, and non-profit organizations. The role focuses on improving operational effectiveness and internal controls.

Frequently Asked Questions On Accounting

1. Can I study Accounting without Economics in JAMB?

No, Economics is mandatory for JAMB subject combination for Accounting across all Nigerian universities. You cannot substitute it with any other subject. Register for Mathematics, Economics, and one Social Science subject.

2. What is the minimum JAMB score for Accounting in federal universities?

Federal universities typically require 180 to 220 points for Accounting. However, competitive institutions like University of Lagos often admit candidates with 200 points and above. Check specific university cut-off marks annually.

3. Can I use Government and Geography as my other two subjects?

Yes, after Mathematics and Economics, you can choose either Government or Geography as your third subject. Some universities accept both, but check your preferred institution’s specific requirements before registration.

4. Do private universities accept lower JAMB scores for Accounting?

Private universities generally accept candidates from 140 points upward for Accounting. However, they maintain strict O’Level requirements and may charge higher fees. Each institution sets independent admission criteria.

5. Can I gain admission with three sitting results?

Most universities reject candidates with results from three different examination sittings. The standard requirement remains two sittings maximum. Plan your examinations carefully to avoid this disqualification.

6. Is Commerce compulsory for studying Accounting?

Commerce is not compulsory but helpful for Accounting admissions. Universities accept Commerce as one of your additional subjects alongside Economics and Mathematics. Some institutions prefer it over other Social Science options.

7. What Direct Entry qualifications are accepted for Accounting?

Universities accept A’Level passes, NCE in Business Education, OND or ND in Accountancy, and HND in relevant programs. You need minimum Upper Credit for diploma holders and Merit for NCE candidates.

8. Can I study Accounting without Mathematics in O’Level?

No, Mathematics credit is compulsory for all Accounting programs in Nigerian universities. You cannot proceed with your application without this requirement. Retake your O’Level examination if you lack Mathematics credit.

9. Which universities offer waiver for JAMB subject combination in Accounting?

Very few universities offer subject waivers for Accounting. University of Benin and Obafemi Awolowo University occasionally grant exceptions under special circumstances. However, Mathematics and Economics remain mandatory across all institutions.

10. How long does Accounting program take in Nigerian universities?

The standard Accounting program runs for four years through UTME admission. Direct Entry candidates complete the program in three years. Some universities operate five-year programs for candidates requiring remedial courses.

Source: Jamb Brochure